Does Your Homeowner's Policy Cover Storm Water Intrusion?

Jump To:

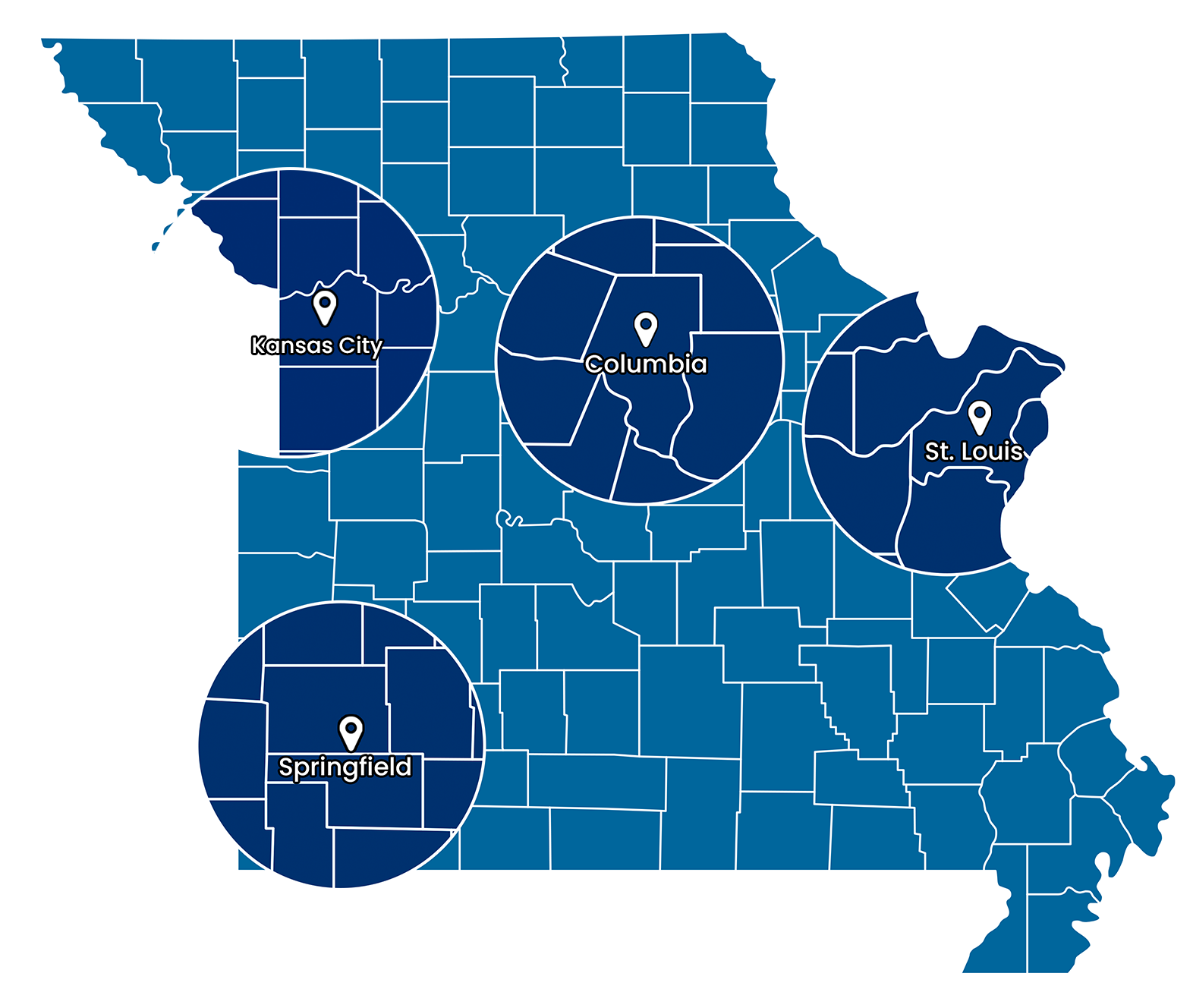

Let's be honest, nobody reads their homeowner's insurance policy until disaster strikes. But when storm water starts pouring into your basement or seeping through your walls after those intense Missouri thunderstorms, you'll wish you'd taken a closer look at the fine print. We've seen too many St. Louis area homeowners get blindsided by coverage gaps when they need help most.

Heavy Missouri thunderstorms can overwhelm drainage systems and create unexpected pathways for water intrusion into your home.

The truth is, storm water coverage isn't as straightforward as you might think. Your standard homeowner's policy might have your back in some situations, but leave you high and dry in others. Let's break down what you need to know to protect your home and wallet from Missouri's unpredictable weather.

Get Emergency Water Damage Help →

Common Coverage Gaps That Leave Missouri Homeowners Vulnerable

Your homeowner's policy covers a lot, but storm water intrusion falls into some tricky gray areas that can catch you off guard.

Storm Water Coverage: What's Covered vs. What's Not

✓ Usually Covered

Wind-driven rain through roof or walls during storms

✗ Usually NOT Covered

Ground-level flooding or surface water intrusion

✓ Usually Covered

Sudden burst pipes or plumbing failures

✗ Usually NOT Covered

Gradual seepage or maintenance-related water entry

Flood vs. Wind-Driven Rain: The Big Distinction

Here's where things get complicated. If wind drives rain through your roof or siding during a storm, you're typically covered. But if water enters from ground level because of poor drainage or overwhelmed storm systems, that's often considered flooding, and standard policies don't cover floods.

After heavy storms, homeowners discover water damage in their basements and assume their insurance will handle it. Sometimes they're right, sometimes they're in for an expensive wake-up call - especially when appliance malfunctions compound the problem.

Gradual Seepage vs. Sudden Intrusion

Insurance companies love this distinction. If storm water slowly seeps through foundation cracks over several days, that's gradual damage and typically not covered. But if the same water bursts through during a single storm event, you might have coverage.

The challenge? Proving exactly how and when the water entered can be nearly impossible after the fact. Understanding the common causes of water damage can help you document incidents properly for insurance claims.

Maintenance-Related Exclusions

Insurance doesn't cover problems you could have prevented with regular maintenance. Clogged gutters, cracked foundations, or deteriorating sealants that allow storm water entry won't be covered, even during severe weather events. Learning about what not to do after water damage can help you avoid making coverage situations worse.

Key Policy Language to Look For

Reading insurance policies isn't exactly fun, but understanding these key terms can save you thousands.

Water Damage Coverage Definitions

Look for how your policy defines "water damage" and pay attention to exclusions. Many policies cover "sudden and accidental" water damage but exclude "flood," "surface water," or "water that backs up through sewers or drains."

Named Perils vs. Open Perils

Named perils policies only cover specific events listed in your policy. Open perils (or "all risk") policies cover everything except what's specifically excluded. For storm water intrusion, open perils typically offer better protection.

Need Help Understanding Your Coverage?

Don't wait until disaster strikes to understand your policy. Our water damage restoration experts work with insurance companies daily and can help you understand what's covered and what's not.

Get Expert Advice →Ordinance and Law Coverage

After storm damage, you might need to bring repairs up to current building codes. Standard policies often don't cover these additional costs, but ordinance and law coverage can fill this gap.

Additional Living Expenses

If storm water damage makes your home unlivable, this coverage pays for temporary housing and increased living costs. Make sure your limits are realistic for current hotel and rental prices in the St. Louis area.

Supplemental Protection Options in Missouri

Smart homeowners don't rely on basic coverage alone. Here are additional protections worth considering.

| Coverage Type | What It Covers | Typical Cost | Worth It for STL Area? |

|---|---|---|---|

| NFIP Flood Insurance | Rising water from external sources | $400-800/year | Yes |

| Sewer Backup Coverage | Water backing up through drains | $50-150/year | Highly Recommended |

| Service Line Coverage | Underground utility line repairs | $25-75/year | Consider It |

| Private Flood Insurance | Alternative to NFIP with higher limits | Varies widely | Compare Options |

National Flood Insurance Program (NFIP)

Even if you're not in a high-risk flood zone, you can purchase federal flood insurance through the NFIP. There's typically a 30-day waiting period, so don't wait until storm season to buy coverage.

Private Flood Insurance

Private insurers increasingly offer flood coverage that can supplement or replace NFIP policies. These often provide higher coverage limits and may include additional living expenses.

Sewer and Water Backup Coverage

This relatively inexpensive endorsement covers water damage from backed-up sewers, sump pumps, and drains. We've seen firsthand how plumbing issues homeowners should never ignore can create perfect conditions for storm water problems.

Service Line Coverage

Covers repair or replacement of underground utility lines on your property. While not directly related to storm intrusion, damaged sewer or water lines can exacerbate storm water problems.

Understanding Missouri-Specific Weather Risks

Our area faces unique challenges that affect coverage decisions.

Severe Thunderstorm Season

Missouri's severe thunderstorm season runs from March through August, with peak activity in spring and early summer. These storms can produce heavy rainfall, hail, and tornadoes that create multiple pathways for water intrusion.

Flash Flooding Potential

The St. Louis metro area's topography and development patterns create flash flooding risks even in areas not traditionally considered flood-prone. Standard homeowner's policies don't cover this type of flooding.

Basement Vulnerabilities

Many local homes have basements that are particularly vulnerable to storm water intrusion. Understanding how your policy treats below-grade water damage is crucial, especially when you consider how appliance malfunctions can cause water damage that might complicate insurance claims.

What to Do Before Storm Season

Prevention and preparation beat dealing with coverage gaps after damage occurs.

Regular gutter maintenance is essential for preventing storm water intrusion and maintaining your insurance coverage eligibility.

Storm Water Intrusion Prevention Checklist

- Inspect and clean gutters and downspouts: Ensure water flows away from your foundation

- Check foundation sealing: Look for cracks or gaps where water might enter

- Test sump pump operation: Replace backup batteries and verify proper drainage

- Verify grading around your home: Water should slope away from your foundation

- Trim trees and secure outdoor items: Reduce wind-driven debris risks

- Document your property condition: Take photos and videos for insurance purposes

- Review your policy annually: Understand your coverage and consider supplemental options

Review Your Coverage Annually

Insurance needs change as homes age and weather patterns evolve. What made sense five years ago might not provide adequate protection today.

Document Your Property

Before storm season, photograph and video your property's condition. This documentation can be crucial if you need to prove that damage resulted from a covered storm event rather than pre-existing conditions. Many homeowners don't realize that common plumbing issues they should never ignore can become major problems during storms.

When Storm Water Damage Occurs: Quick Action Steps

If you discover storm water intrusion, here's what you need to do immediately:

- Ensure safety first: Turn off electricity to affected areas and avoid standing water

- Contact your insurance company: Report the claim as soon as possible

- Document everything: Take photos and videos of damage before cleanup begins

- Prevent further damage: Take reasonable steps to protect your property

- Call professionals: Don't attempt major cleanup without proper equipment and expertise. Our mold removal services can address secondary issues that often develop after storm water intrusion

Need Emergency Water Damage Help? Call Now →

Working with Insurance After Storm Damage

The claims process can be stressful, but understanding what to expect helps.

Be Thorough with Documentation

Insurance adjusters need detailed information about how damage occurred. The more documentation you have about the storm event and resulting damage, the better your chances of a successful claim.

Understand Depreciation

Many policies pay replacement cost value, but initial payments often reflect actual cash value (replacement cost minus depreciation). You'll typically receive the depreciation amount after completing repairs.

Know Your Rights

If your claim is denied or you disagree with the settlement, you have options. Consider hiring a public adjuster or consulting with an attorney who specializes in insurance disputes.

Frequently Asked Questions

Does homeowner's insurance cover basement flooding from storms?

It depends on how the water entered. If it came through windows or foundation cracks due to wind-driven rain, you might have coverage. If it's from ground-level flooding or sewer backup, standard policies typically don't cover it without additional endorsements.

How long do I have to file a storm water damage claim?

Most Missouri homeowner's policies require prompt notification, typically within 30-60 days of discovering damage. However, you should report claims as soon as possible after a storm event for the best outcome.

What's the difference between flood insurance and storm water coverage?

Homeowner's insurance may cover wind-driven rain intrusion, while flood insurance covers rising water from external sources. Many storm water situations fall into gray areas between these coverages.

Should I buy flood insurance if I'm not in a flood zone?

Consider it, especially in the St. Louis area where flash flooding can occur outside traditional flood zones. About 25% of flood claims come from moderate-to-low risk areas, and the coverage is typically affordable outside high-risk zones.

Nobody wants to deal with storm water damage, but understanding your insurance coverage before you need it can save you thousands and a lot of stress. Take time now to review your policy, consider supplemental coverage, and prepare your property for Missouri's unpredictable weather.

Remember, when storm water does find its way into your home, quick professional action is essential. Our team at ABC Environmental Contracting Services has helped countless St. Louis area homeowners restore their properties after storm damage. We understand the insurance process and can help document damage properly while getting your home back to normal as quickly as possible.

Don't wait until the next storm to think about protection – review your coverage today and make sure you're prepared for whatever Missouri weather brings your way.

Dan and Tina Benton are the owners of ABC Environmental Contracting Services, a veteran-owned restoration company serving the St. Louis Metro East area. Together, they bring over two decades of expertise in water damage restoration, mold remediation, and asbestos removal for both residential and commercial properties. They're committed to serving their community with integrity and dedication, providing 24/7 emergency response when disaster strikes.