Water Damage Red Flags That Make Insurance Companies Deny Claims

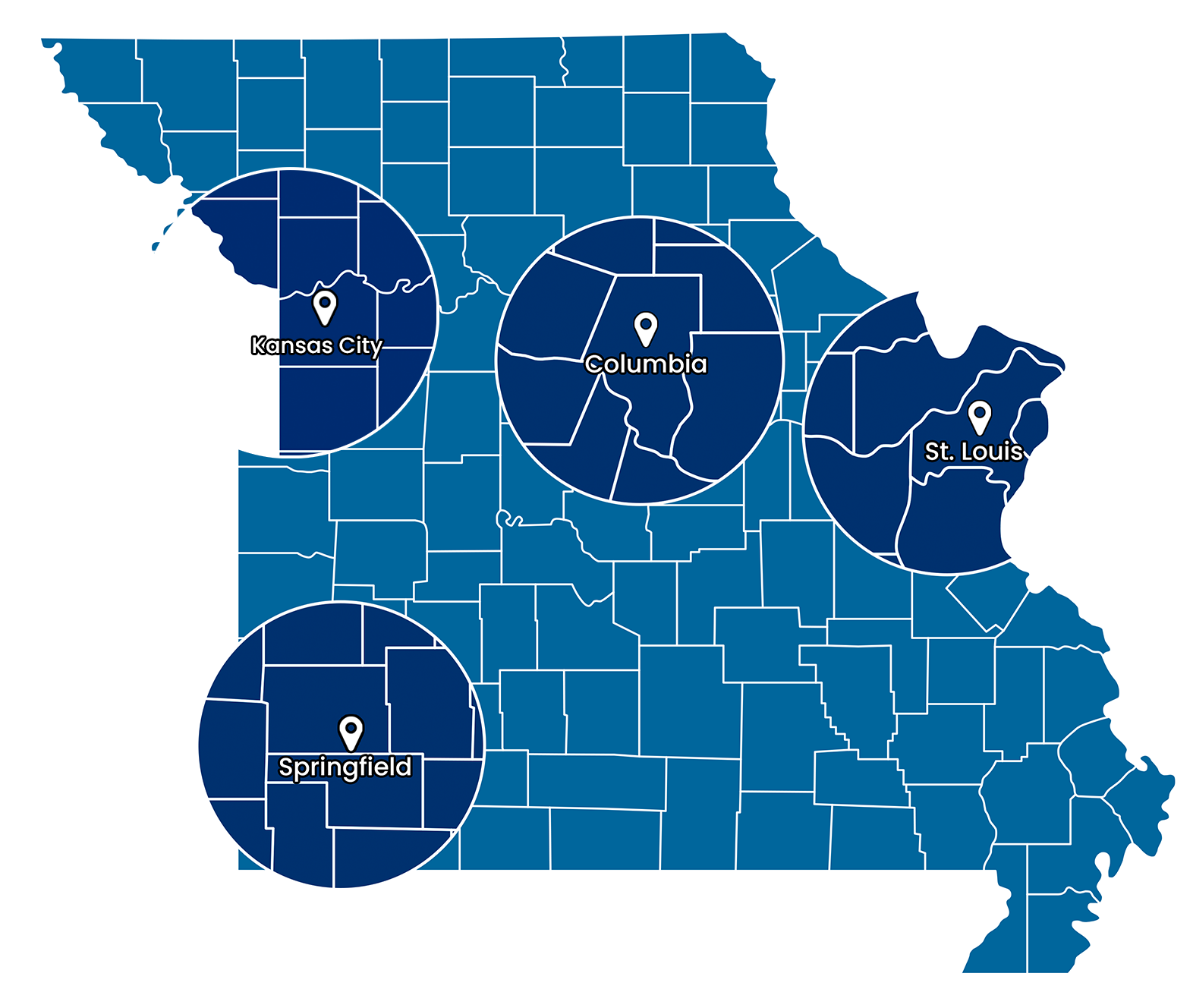

When water damage strikes your St. Louis home, the last thing you want is an insurance claim denial. Unfortunately, we see homeowners make critical mistakes that give insurance companies reasons to say no. Our team at ABC Environmental Contracting Services has worked with countless families through the claims process, and we've learned exactly what sends up red flags for adjusters.

Let's walk through the biggest claim killers so you can protect yourself when disaster hits. Trust me, a little knowledge now can save you thousands later.

Insurance Claim Red Flags at a Glance

Timeline Issues

Delayed reporting or inconsistent dates

Poor Documentation

Missing photos or incomplete records

DIY Attempts

Inadequate cleanup leading to bigger problems

Maintenance Neglect

Evidence of preventable damage

The Timeline Trap: Why Speed Matters More Than You Think

Insurance companies are obsessed with timelines. They want to know exactly when damage occurred, when you discovered it, and how quickly you acted. Any gaps or inconsistencies in your timeline can trigger suspicion.

What Triggers Red Flags:

- Reporting damage weeks after it actually happened

- Unable to explain exactly when the water intrusion started

- Long delays between discovery and action

- Conflicting dates in your documentation

Here's the thing: most policies require "prompt" notification. If you wait too long, insurers assume you either caused the damage yourself or let it get worse through neglect. Neither scenario works in your favor.

Pro tip: Call your insurance company immediately after discovering any water damage, even if you're not sure how extensive it is yet. You can always update them as you learn more, but you can't go back in time to report it sooner.

Understanding common causes of water damage helps you identify issues quickly and report them appropriately to your insurer.

Documentation Disasters That Sink Claims

This might be the biggest mistake we see. Homeowners either document nothing or document the wrong things entirely. Your phone's camera is your best friend in these situations, but only if you use it correctly.

The Wrong Way to Document:

- Taking photos only after cleanup begins

- Focusing on irrelevant details while missing the big picture

- Blurry, poorly lit images that don't show the scope

- No "before and after" comparison shots

- Missing receipts for emergency services

The Right Approach:

Take photos and videos of EVERYTHING before touching anything. Show the water source, the affected areas, damaged belongings, and the extent of saturation. Document any temporary fixes you make to stop further damage. Keep every receipt, even for towels and fans you bought to help with cleanup.

We always tell our clients: if you're questioning whether to photograph something, photograph it. You can delete extras later, but you can't recreate the scene once cleanup starts.

Need Help with Water Damage Documentation?

Our professionals know exactly what insurance companies need to see. Don't risk your claim with incomplete documentation.

Get Professional Help NowThe "DIY Disaster" Red Flag

We get it, nobody wants to pay for professional help if they think they can handle water damage themselves. But insurance companies see DIY cleanup attempts as major red flags, especially when they go wrong.

What Makes Insurers Nervous:

- Using regular household fans instead of professional drying equipment

- Attempting to clean category 2 or 3 water without proper safety gear

- Removing wet materials without proper documentation

- Missing hidden moisture that leads to mold problems later

- No professional moisture readings or drying logs

The problem isn't that you tried to help, it's that inadequate drying often creates bigger problems down the road. When mold shows up three weeks later, insurance companies start asking whether the original water damage was properly mitigated.

Learning what not to do after water damage can prevent costly mistakes that jeopardize your insurance claim.

Common Preventable Issues That Scream "Negligence"

Insurance policies don't cover damage from maintenance issues you should have addressed. If adjusters find evidence of ongoing problems, they'll likely deny your claim entirely.

Red Flags That Suggest Poor Maintenance:

- Multiple small leaks that were ignored over time

- Clogged gutters that caused water intrusion

- Old, deteriorating roof materials that finally failed

- Plumbing issues you knew about but didn't fix

- Missing caulk around tubs and showers

- Cracked foundation that allowed water seepage

The key word here is "sudden and accidental." If the damage resulted from a problem that developed gradually, insurers consider it a maintenance issue rather than a covered loss.

Recognizing early signs of water damage can help you address issues before they become major problems that insurers might consider preventable.

Quick Maintenance Checklist:

- Check and clean gutters seasonally

- Inspect plumbing fixtures for leaks regularly

- Replace worn caulk and weatherstripping

- Address roof issues promptly

- Monitor your water bill for unexpected increases

- Know where your main water shut-off valve is located

The Communication Breakdown That Costs You

How you communicate with your insurance company can make or break your claim. We've seen perfectly valid claims get denied because homeowners said the wrong thing or provided conflicting information.

| Communication Mistakes | Better Approach |

|---|---|

| Speculating about the cause before you know for sure | Stick to facts only; say "I don't know" when uncertain |

| Providing different versions of events to different people | Keep detailed notes and stay consistent |

| Admitting to any potential negligence or fault | Report facts without assigning blame to yourself |

| Agreeing to settlement amounts before understanding full costs | Get professional assessments before accepting offers |

| Not asking questions when you don't understand something | Always ask for clarification in writing |

Stick to facts. If you don't know something, say you don't know rather than guessing. Insurance adjusters are trained to catch inconsistencies, and they'll use them against you.

According to the Insurance Information Institute , clear and consistent communication with your insurer from the start significantly improves your chances of a successful claim outcome.

The Hidden Costs That Catch Everyone Off Guard

One of the biggest mistakes we see is homeowners accepting the first settlement offer without understanding the full scope of needed repairs. Insurance companies often lowball initial offers, hoping you'll take the money and run.

Costs Often Overlooked in Initial Estimates:

- Moisture testing and monitoring during drying

- Antimicrobial treatments to prevent mold

- Replacement of insulation damaged by water

- Electrical work if water reached outlets or wiring

- HVAC duct cleaning if water affected air systems

- Flooring substructure replacement

- Permit costs for reconstruction work

Don't sign anything until you've had the damage professionally assessed. What looks like a simple cleanup job often involves much more extensive work once you get into the walls and under the flooring.

Steps to Protect Your Claim from Day One

Knowledge is power when it comes to insurance claims. Here's your action plan for protecting yourself:

Immediate Actions:

- Stop the water source if safely possible

- Call your insurance company right away

- Document everything with photos and videos

- Begin water extraction if you can do it safely

- Contact professional restoration services

Ongoing Protection:

- Keep detailed records of all conversations with your insurer

- Save every receipt related to the damage or cleanup

- Don't throw away damaged items until your adjuster sees them

- Get written estimates from qualified contractors

- Don't accept the first settlement offer automatically

Documentation Best Practices:

- Date and time stamp all photos

- Create a written inventory of damaged items

- Keep a log of everyone you speak with about the claim

- Save all correspondence in one organized file

- Take "after" photos showing completed professional work

Working with Your Insurance Adjuster

The adjuster isn't necessarily your enemy, but they work for the insurance company, not for you. Their job is to settle claims for as little as possible while staying within policy guidelines.

What Adjusters Look For:

- Consistency in your story and documentation

- Evidence of proper maintenance and care

- Reasonable response to the emergency

- Professional handling of the cleanup and restoration

- Accurate and complete damage assessment

Red Flags from Their Perspective:

- Homeowners who seem to know too much about insurance policies

- Claims that happen right after policy changes or purchases

- Damage that seems inconsistent with the reported cause

- Missing or suspicious documentation

- Previous claims for similar issues

Stay professional, stick to facts, and let your documentation speak for itself.

Why Professional Help Matters for Your Claim

Here's something most homeowners don't realize: having professional restoration work done actually strengthens your insurance claim. It shows you took the damage seriously and handled it appropriately.

Professional services provide:

- Detailed moisture readings and drying logs

- Before, during, and after photo documentation

- Industry-standard cleanup and restoration protocols

- Written reports that adjusters understand and trust

- Proper disposal of contaminated materials

- Air quality testing when needed

We work with insurance companies regularly, so we know what they expect to see in a claim file. Our documentation helps ensure your claim gets processed smoothly and you receive fair compensation for your losses.

For more specific guidance on handling different water damage scenarios, check out our comprehensive drywall water damage services in the greater St. Louis area.

FAQs About Insurance Claim Red Flags for Water Damage

Q: If I discover water damage but don't know exactly when it started, how should I report it to avoid timeline red flags?

A: Be completely honest about what you know and don't know. Report it as soon as you discover it, explain when you first noticed the issue, and state clearly if you're unsure when the actual damage began. Adjusters appreciate honesty more than guesswork that might contradict evidence later.

Q: What's the biggest documentation mistake that leads to claim denials?

A: Taking photos only after cleanup has started. Insurance companies need to see the original extent of damage to verify your claim. If you've already removed water or damaged materials, they may question whether the damage was as severe as you claim.

Q: How can I tell the difference between maintenance-related damage and sudden accidental damage for insurance purposes?

A: Sudden damage has a clear, identifiable cause and timeline (like a pipe bursting), while maintenance issues develop gradually over time. If you've had small leaks, stains, or other warning signs that you ignored, insurers will likely consider the resulting damage preventable and deny coverage.

Q: What should I do if I started DIY cleanup before realizing I should call professionals?

A: Document what you've already done with photos and notes, then call professionals immediately for the remaining work. Be upfront with your insurance company about the initial steps you took. Having professional restoration for the majority of the work can still strengthen your claim, even if you started on your own.

Water damage is stressful enough without worrying about insurance claim problems. By avoiding these red flags and documenting everything properly, you'll give yourself the best chance of a smooth claims process and full compensation for your losses.

If you're dealing with water damage in the St. Louis area, don't go it alone. Our team at ABC Environmental Contracting Services knows how to handle both the restoration work and the insurance documentation to protect your interests. We're here 24/7 to help when water damage strikes.

Call us at (314) 668-1509 or contact us online for fast, professional water damage restoration that insurance companies trust and homeowners appreciate.

Dan and Tina Benton are the owners of ABC Environmental Contracting Services, a veteran-owned restoration company serving the St. Louis Metro East area. Together, they bring over two decades of expertise in water damage restoration, mold remediation, and asbestos removal for both residential and commercial properties. They're committed to serving their community with integrity and dedication, providing 24/7 emergency response when disaster strikes.