Does Renters Insurance Cover Flood Damage? What You Need to Know

Understanding what renters insurance water damage policy covers is very important for protecting your belongings. Many renters may not realize the differences between types of water damage and how insurance policies address them. If you're renting, you need to know the specifics to make sure you’re adequately protected. Knowing when to call a

Water Damage Restoration St Louis company or any other local experts can also save you a lot of headaches. So, does renters insurance cover flood damage, and will renters insurance cover water damage? Let’s find out.

What is Renters Insurance?

Renters insurance is a policy that provides coverage for your personal belongings, liability, and additional living expenses when a disaster happens. You need this insurance to protect your possessions. Many people mistakenly believe renters insurance covers all types of water damage, but this is not the case.

Flood Damage vs. Water Damage

It's important to distinguish between flood damage and other types of water damage:

- Flood Damage: This is damage caused by natural events like heavy rain, overflowing rivers, or storm surges. If water from outside enters your home and causes damage, it's considered flood damage.

- Water Damage: This includes damage from incidents like a burst pipe, a leaking appliance, or a roof leak. These scenarios typically involve water that originates from inside the home.

Does Renters Insurance Cover Flood Damage?

When it comes to flood damage, most standard renters insurance policies fall short. This can be a surprise to many renters, as they often assume their policy covers all types of water-related incidents. However, it's important to understand the specifics of your renter's insurance policy to avoid any unpleasant surprises. Standard renters insurance typically covers personal property, liability, and additional living expenses if your rented home becomes uninhabitable due to a covered peril. However, flood damage caused by natural events is usually excluded. This means that if water from heavy rain, overflowing rivers, or storm surges enters your home and causes damage, your renter's insurance won't cover it. Flood damage is often excluded from standard renters insurance policies because of the high risk and potential costs associated with floods. Floods can cause complicated and widespread damage, making them a significant financial risk for insurance companies. As a result, insurers generally require a separate policy to cover such events.

Does Renters Insurance Cover Water Damage?

While it may not cover flood damage, standard renters insurance cover water damage of other types, such as:

- Burst Pipes: If a pipe bursts in your apartment and damages your belongings, renters insurance generally covers this.

- Leaking Roofs: Damage caused by water leaking through a roof is typically covered.

- Appliance Leaks: If your washing machine or dishwasher leaks and damages your personal items, renters insurance usually provides coverage.

Additional Coverage Options

To fully protect yourself, consider these additional coverage options:

- Flood Insurance: Separate flood insurance is necessary to cover damages from natural flooding events. This policy can be purchased through the National Flood Insurance Program (NFIP) or private insurers.

- Water Damage Endorsements: Some insurers offer endorsements or additional policies that cover specific water damage scenarios not included in standard renters insurance.

Steps to Take After Water Damage

If you experience water damage, it’s essential to act quickly to minimize further damage and secure your safety. Follow these immediate steps:

Safety First

Your safety should be your top priority. Before entering the affected area, make sure it’s safe. Water and electricity are a dangerous combination. If the water damage is near any electrical outlets, switches, or appliances, turn off the electricity at the main breaker to prevent electrical shocks or fires. In addition, if the water damage is caused by a flood or sewage backup, the water could be contaminated. Avoid contact with the water to prevent health risks.

Document the Damage

Careful documentation is important for insurance claims. Use your phone or camera to take clear photos of all the damage. Capture images of the affected areas, damaged items, and any standing water. Create a detailed inventory of damaged items, including their approximate value. This will help simplify the insurance claims process and ensure you get adequate compensation.

Notify Your Landlord

It is very important to inform your landlord quickly, as they may need to take action to prevent further damage and handle structural concerns. Call or email your landlord as soon as you discover the water damage. Provide them with details about the extent of the damage and how it happened. Keep records of your communications with your landlord, including emails, text messages, and notes from phone calls.

Contact Your Insurer

Start the insurance claims process as soon as possible. Contact your insurance company to report the water damage. Provide them with all necessary details and documentation. Your insurer will guide you through the next steps, which may include meeting with an adjuster or providing additional documentation. Follow their instructions carefully to make this process easier.

Seek Professional Help

Professional restoration services are needed for successful cleanup and to prevent further damage. Look for experienced and trustworthy restoration companies. Professional services have the equipment and expertise to handle water damage thoroughly. The sooner you contact restoration professionals, the better. Fast action can prevent mold growth, structural damage, and other long-term issues.

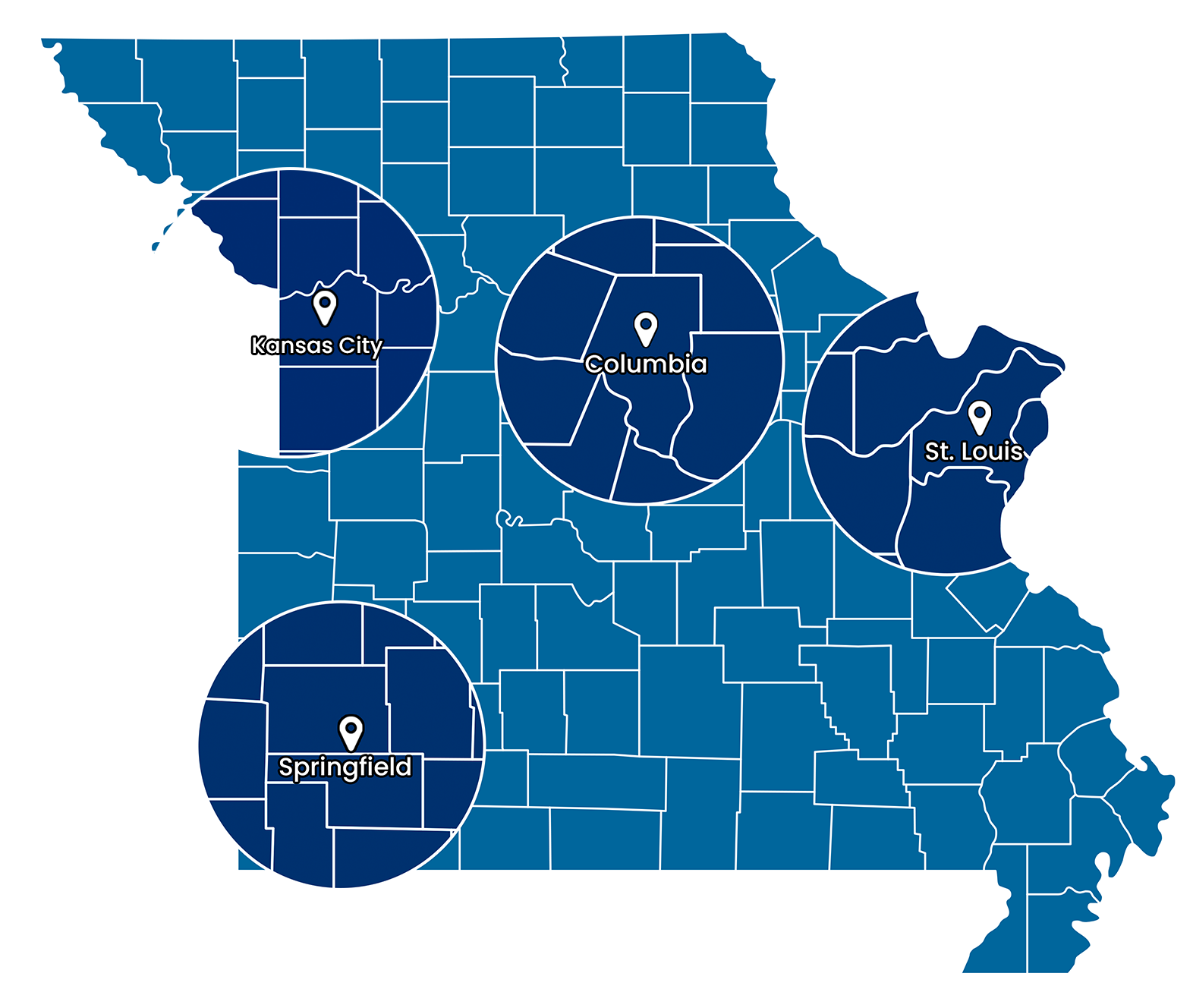

Contact ABC Environmental Contracting Services Today

If you've experienced water damage, don't wait to get the help you need. ABC Environmental Contracting Services is here to provide professional, reliable, and successful water damage restoration services. Our experienced team is ready to assist you in restoring your home and securing your safety. Call us today at (314) 668-1509 or fill out an online form on our website.